Here's how the super-rich are investing their assets this year

News24

11 Jul 2019, 11:43 GMT+10

High net-worth individuals have significantly shifted their asset allocation, with cash becoming the largest asset class in the first quarter of 2019, according to the Capgemini World Wealth Report 2019.

The survey found that HNWIs have an increased focus on alternative investments in response to declining markets.

"Declining markets drove a significant shift in overall asset allocations to conservative assets such as cash.

"Globally, cash and cash equivalents replaced equities to become the most significant asset class in Q1 2019 at 28% of HNWI financial wealth, while equities slipped to the second position at 26%," Anirban Bose, financial services strategic business unit CEO at Capgemini, states in the report.

For the purposes of the report, HNWIs is defined as those having investable assets of US$1 (about R14.17m) or more - therefore, excluding their primary residence, collectibles, consumables and consumer durables. HNWIs is further broken down into the categories of "millionaires next door" (US$1m to US$5m in investable wealth); mid-tier millionaires (US$5m to US$30m); and ultra-HNWIs (US$30m or more).

After seven consecutive years of growth, global HNWI wealth declined in 2018, primarily driven by a slump in equity-market performance and slowing economies in key regions, according to Bose.

The wealth of ultra-HNWIs (1% of HNWIs) declined 6% but accounted for three-quarters of total global wealth decline and was the hardest hit by global economic and political turbulence.

Amid geopolitical and trade concerns, the report expects near-term global economic recovery to remain uncertain.

SA's super rich taking their wealth overseas ASAP - immigration expert

In Africa the size of the HNWI population decreased by 0.7% in 2018, while wealth on the continent decreased by 7.1% to US$1.6trn. The HNWI population on the continent is estimated at 166 790.

As for South Africa, the report estimates that the country had about 90 100 HNWIs by the end of 2018 compared to 92 200 a year earlier.

Globally, Asia-Pacific, a global powerhouse for the last seven years, was negatively impacted the most, with China accounting for almost 25% of global wealth decline, while Europe also experienced a noticeable dip in HNWI wealth, according to the report.

The Middle East recorded the only increase in both HNWI wealth and population. North America's performance remained almost flat, while Latin Americas performance is described as mixed.

Among wealth bands, economic turbulence hit ultra-HNWIs hardest. Ultra-HNWI population and wealth declined by around 4% and 6% respectively, compared with almost fat overall HNWI population growth and a 3% decline in HNWI wealth.

Meanwhile, the millionaire-next-door segment (which makes up almost 90% of the HNWI population) was affected the least in 2018.

HNWI population in South Africa:

(Source: Capgemini World Wealth Report 2019)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of London Mercury news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to London Mercury.

More InformationUK Editorials

SectionBusiness

SectionRising costs, supply strains hit producers as US tariff deadline looms

WASHINGTON, D.C.: As the deadline for new U.S. steel and aluminum tariffs approaches, manufacturers across the country are already...

EC to ease sustainability rules to boost business competitiveness

BRUSSELS/LONDON: The European Commission is preparing to ease sustainability reporting requirements for businesses as part of a broader...

U.S. stocks end in disarray, techs boosted by Nvidia

NEW YORK, New York - U.S. stocks were in disarray again on Wednesday with the Standard and Poor's 500 dropping for the fifth day in...

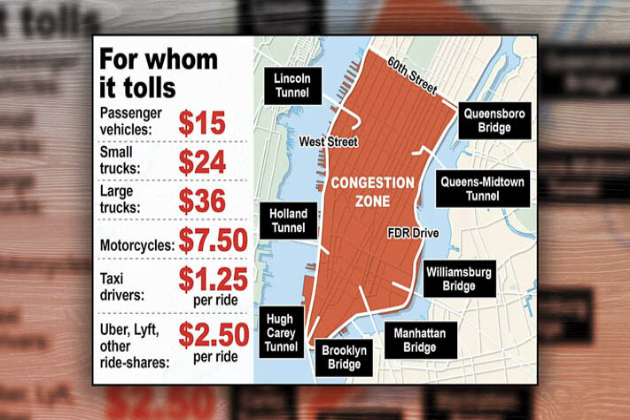

NY Governor defends Manhattan congestion toll in meeting with Trump

NEW YORK CITY, New York: Governor Kathy Hochul met with President Donald Trump in the Oval Office to defend Manhattan's congestion...

Florida claims Target ‘misled investors’ with its DEI initiatives

TALLAHASSEE, Florida: Florida's new attorney general, James Uthmeier, filed a federal lawsuit against Target this week, claiming the...

Foxconn seeks Honda as a partner, eyes ties with Nissan, Mitsubishi

TOKYO, Japan: Foxconn has approached Honda Motor with a proposal to form a partnership, aiming to establish a broader collaboration...