Stocks fall on deepening virus concerns

News24

27 Jan 2020, 23:44 GMT+10

Global markets tumbled on Monday as investors scurried to less riskier assets due to concerns over the deadly coronavirus which many fear China has failed to contain.

With rising cases of detection in other countries outside of China, there are concerns that the impact of the virus could be widespread. Chinese equity markets were closed for a holiday, therefore, there was no sentiment that came directly from that market.

However, the pessimism was evident on the Japanese Nikkei were that market closed 2.03% lower. In Europe, markets fell by an average of at least 2% while US equity markets opened sharply lower.

The rand tumbled along with other emerging markets as investors ran for safe-haven currencies. The rand fell to a session low of R14.59/$ before it was recorded trading 1.25% weaker at R14.56/$ at 17:00 CAT.

All the major stocks struggled on the day with significant losses being recorded for the resources index. Kumba Iron Ore [JSE:KIO] fell 5.91% to close at R358.55, Northam Platinum [JSE:NHM] dropped 5.84% to close at R115.30, and coal miner Exxaro Resources [JSE:EXX] closed at R123.31 after losing 4.46%.

Diversified mining giant, Anglo American PLC [JSE:AGL] dropped 3.81% to close at R388.88, while oil and gas producer Sasol [JSE:SOL] slipped 3.73% to close at R254.63.

Index heavyweight, Naspers [JSE:NPN] lost 3.63% to close at R2 377.46, while Dis-Chem Pharmacies [JSE:DCP] fell 2.92% to close at R26.27.

Significant losses were also recorded for EOH Holdings [JSE:EOH] which lost 5.15% to close at R9.21, Standard Bank [JSE:SBK] which weakened by 2.38% to close at R159.65, and Woolworths [JSE:WHL] which closed at R46.15 after dropping 3.15%.

Only a couple of stocks managed to record significant gains on the day. Liberty Two Degrees [JSE:L2D] surged 7.48% to close at R6.90, while Lighthouse Capital [JSE:LTE] added 1.5% to close at R8.80.

A few gold miners managed to rally on the day which saw stocks such as AngloGold Ashanti [JSE:ANG] gain 4.63% to close at R307.02, Gold Fields [JSE:GFI] which surged 2.47% to close at R93.67, as well as Harmony Gold [JSE:HAR] which closed at R52.23 after gaining 2.41%.

The JSE Top-40 index fell 2.47% while the broader JSE All-share Index lost 2.37%. All the major indices fell on the day. Industrials lost 2.53%, resources tumbled 2.59%, and financials lost 1.86%.

At 17:00 CAT, gold was up 0.62% at R1 580.12/Oz, platinum had lost 1.46% to trade at $986.62/Oz, and palladium was 4.15% weaker at $2 327.03/Oz.

Brent crude has slumped on the back of the virus concerns. The commodity was trading 1.69% weaker at $58.92/barrel just after the JSE close.

* Musa Makoni is a trading specialist at Purple Group.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of London Mercury news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to London Mercury.

More InformationUK Editorials

SectionShould irresponsible hikers be forced to pay for their rescue? This sheriff says yes

Should irresponsible hikers be forced to pay for their rescue? This sheriff says yes

Man, woman dead in Denver murder-suicide, police say

Man, woman dead in Denver murder-suicide, police say

Mont. governor vetoes bill providing PTSD workers' comp coverage for first responders

Mont. governor vetoes bill providing PTSD workers' comp coverage for first responders

Wanted man challenged deputies to find him then, Fla. cops did just that

Wanted man challenged deputies to find him then, Fla. cops did just that

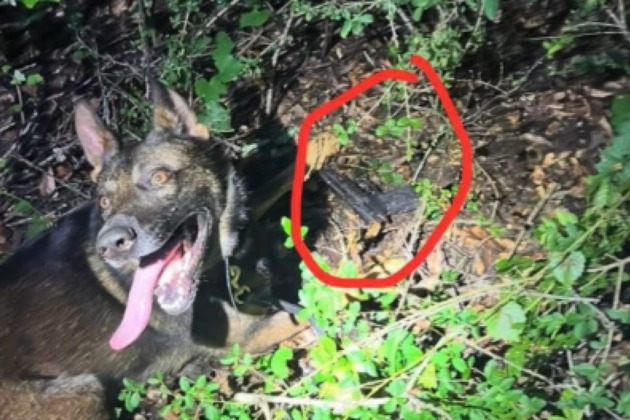

Video shows Slidell Police K-9 finding gun used to fire at officers

Video shows Slidell Police K-9 finding gun used to fire at officers

Massachusetts State Police address public after Karen Read verdict

Massachusetts State Police address public after Karen Read verdict

Business

SectionNext-gen weight-loss drugs aim to cut fat, spare muscle

WASHINGTON, D.C.: As the global weight-loss market explodes, drugmakers are now racing to solve a less visible problem: protecting...

Amazon’s Zoox unveils plan to build 10,000 robotaxis a year

HAYWARD, California: In a significant step toward its commercial debut, Amazon-owned Zoox has unveiled its first factory dedicated...

Brazil aims to restart poultry trade after bird flu clearance

SAO PAULO, Brazil: Brazil is taking confident steps to restore its dominance in global poultry exports after declaring its commercial...

U.S. stocks restricted by tensions in Middle East

NEW YORK, New YorK - U.S. stocks closed mixed on Friday, with gains and losses modest, as investors and traders weighed up the escalation...

US consumers cut back after early surge ahead of Trump tariffs

WASHINGTON, D.C.: Retail sales dropped sharply in May as consumer spending slowed after a strong start to the year, primarily due to...

Mitsubishi joins automakers raising prices after import tariffs

WASHINGTON, D.C.: Mitsubishi Motors is the latest automaker to raise prices in the United States, joining a growing list of car companies...