ANC stalls plan to nationalise SA Reserve Bank

News24

16 Sep 2020, 13:10 GMT+10

A top ruling party official said plans to nationalise the central bank will be shelved as the government wrestles with getting the coronavirus-stricken economy back on track.

The country doesn't have the "massive resources" that may be needed to buy out the bank's private shareholders and spending the money would be unjustified in the current economic climate, said Paul Mashatile, the treasurer-general of the African National Congress.

"We would not want to rush to go in that direction because there are other implications," he said in an interview. "Our view is that we want these resources to be channeled rather to infrastructure projects."

The ANC decided at a conference in 2017 that the state should take ownership of the South African Reserve Bank, one of a handful of central banks owned by private investors, because the prevailing ownership structure infringed on the nation's sovereignty. The shareholders have no say over monetary-policy decisions and the bank's mandate - to ensure price stability - is set out in the constitution.

READ | Tito slams plan to nationalise Reserve Bank, invites critics to 'burn him at the stake'

The Economic Freedom Fighters, which advocates the state seizure of banks, mines and land, has been pressuring the ruling party to follow through on its resolution that the state assume sole ownership of the bank and has tabled a draft law that would trigger the process. Parliament's legal adviser has warned the bill may be unconstitutional, because it would enable the shares to be expropriated without compensation, and ANC lawmakers have indicated they will reject it.

The central bank's shareholders may seek a payout based on its total assets, including the $56 billion of gold and foreign reserves it holds on the country's behalf, Mashatile said.

"That can be a problem, it will make the bank very expensive," he said.

Mashatile also rebuffed suggestions that the government change rules for pension funds to force them to invest in state infrastructure projects that are a central tenet of an economic recovery plan being drafted by the government in consultation with business and labor groups.

"It is not viable," he said. "I think it just creates challenges between government and the investors because when you do prescribe assets you are basically saying to fund managers: 'You shall invest in this project.' You need to give them flexibility to choose. I think it is better not to prescribe, but to create an environment for the pension fund to invest."

Other interview highlights:The Treasury needs to draft changes to ease restrictions on how pension funds deploy clients' money and make it easier for them to invest in infrastructure if they so choose.The government won't rely solely on foreign or private sector funders to drive new infrastructure investment, but will also redirect money of its own.The central bank did a good job in helping offset the fallout from the coronavirus pandemic, despite criticism that it could have done more.The government already has a say in how the central bank implements monetary policy and fulfills its mandate.The process of rationalising state-owned companies needs to be urgently completed.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of London Mercury news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to London Mercury.

More InformationUK Editorials

SectionStory Homes And DUSK Unveil New View Home At Tithe Gardens

Story Homes And DUSK Unveil New View Home At Tithe Gardens

Biden tells CBS News correspondent to "calm down" in peculiar exchange

Biden tells CBS News correspondent to calm down in peculiar exchange

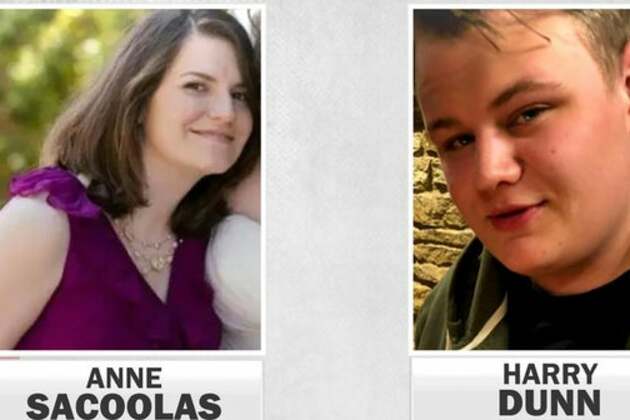

U.S. won't extradite diplomat's wife accused of killing U.K. teen

U.S. won't extradite diplomat's wife accused of killing U.K. teen

ESPN Accused of Using AI for Bizarre Post About 44-Year-Old World Series Champ's Death

ESPN Accused of Using AI for Bizarre Post About 44-Year-Old World Series Champ's Death

Suspect in Border Patrol Ambush Identified - Strange Writing Found on His Car

Suspect in Border Patrol Ambush Identified - Strange Writing Found on His Car

Top Performers in Real Estate 2025 - Hawaii Business Magazine

Top Performers in Real Estate 2025 - Hawaii Business Magazine

Business

SectionBeijing hits back at EU with medical device import curbs

HONG KONG: China has fired back at the European Union in an escalating trade dispute by imposing new restrictions on medical device...

Wall Street reels after Trump invokes new tariffs

NEW YORK, New York - Monday's trading session saw mixed performances across U.S. and global markets, with several major indices posting...

Trump admin allows GE to restart engine sales to China’s COMAC

WASHINGTON, D.C.: The U.S. government has granted GE Aerospace permission to resume jet engine shipments to China's COMAC, a person...

Saudi Aramco plans asset sales to raise billions, say sources

DUBAI, U.A.E.: Saudi Aramco is exploring asset sales as part of a broader push to unlock capital, with gas-fired power plants among...

Russia among 4 systemic risk countries for Italian banks

MILAN, Italy: Italian regulators have flagged four non-EU countries—including Russia—as carrying systemic financial risk for domestic...

US debt limit raised, but spending bill fuels fiscal concerns

NEW YORK CITY, New York: With just weeks to spare before a potential government default, U.S. lawmakers passed a sweeping tax and spending...