How Moving Average Convergence Divergence Is Used

7Newswire

01 Nov 2021, 20:21 GMT+10

Are you looking for ways to elevate your trading? Moving Average Convergence Divergence or MACD is a technical analysis tool you can explore to assist your trading decisions.

How MACD Indicator Works

The stock market is volatile and ever-changing. This is why many traders who decided to take the risk are cautious in every decision they make to avoid significant losses to their investments.

To understand the market and have more profit opportunities, technical tools are developed to interpret charts such as indicators and oscillators to predict the market movements. One of the tools you can try out is the Moving Average Convergence Divergence or MACD. The article about Moving Average Convergence Divergence on LiteForex can assist you in how to use the indicator and interpret them.

Function of MACD

MACD is an additional tool to traders' charts. Traders can use it to determine the connection between two moving averages. Then, the moving average can be plotted together with the MACD to indicate buying and selling signals.

MACD Settings

Once you've entered the charts and use MACD, you can observe the following settings:

- There are three numbers with different assignments. The first is a quick-moving average. Then, the second indicates a much slower moving average. Lastly, the third shows the subtraction of the values between the fast and slow moving averages.

- There are two lines present in the chart. You can observe the MACD line, which can be identified as the fast-moving average. Second, the signal line is known as the slower ones.

- Then, you can observe a histogram that's generated in the charts to plot the difference between the MACD and signal lines. It is the graphical depiction of the distance between the two lines.

Basics of How MACD Operates

Interpreting MACD can be pretty challenging. You need to be aware of the basic lines and symbols to know what it indicates in the chart. Here are some of them:

MACD Zero Line Reference

The zero reference line is a good indication of trends in the market. A bullish trend indicates a rising market price, while bearish implies a falling market price.

When the MACD line touches the zero line and goes up, it is accounted as a rise in the price. In contrast, if the MACD crosses below, it is considered as a fall.

Another use of the reference line is when MACD goes up from below zero, it is regarded as a price increase, and if the MACD goes down from above zero, it is known to be a price decrease.

MACD Signal Line

Like the zero line, you can use the signal line to indicate highs and lows in market prices.

When the MACD line intersects from below, going above the signal line indicates a rising market price. When MACD intersects from above, going below the signal line indicates a falling market price. If the lines move away from the zero lines, the stronger the signal is on the prices.

Still, you need to be observant if MACD moves back and forth, crossing the signal line since it indicates that it's not a good time for trading. Don't try to analyze your charts too fast so that you won't get tricked by false signals.

Histogram

Histograms give traders a signal if a crossover can be expected. As the MACD and signal lines separate, the histogram gets larger and indicates a strong downtrend. On the other hand, if the MACD and signal lines merge, the histogram gets narrower and indicates a strong upward trend.

What Is The Difference Between MACD And Relative Strength

If you're new to trading, you might be thinking that MACD and Relative Strength Indicator (RSI) are the same. They're not. In fact, they are much different from each other. Here is a list differentiating MACD and RSI:

- MACD is the measurement between two moving averages. RSI measures the relationship between price changes and the market's recent high and low prices.

- MACD's purpose is to know the security of prices from the relation of two moving averages, while RSI functions to give you signals whether a market is already overbought or oversold depending on the current prices.

- MACD has a default period of subtracting long-term periods of 26 to short-term periods of 12. On the other hand, RSI has a default period of 14.

Conclusion

MACD can come in handy when you're trading. You can use the signals it gives to know if the prices will go up or down. But be careful of mixed signs that are moving back and forth because they are risky. It's good to research trusted sites to learn more about indicators that you can use together with MACD to have greater confidence when buying and selling shares.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of London Mercury news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to London Mercury.

More InformationUK Editorials

SectionSA Police Commissioner Grant Stevens opens up about 1991 firearm incident

SA Police Commissioner Grant Stevens opens up about 1991 firearm incident

Iran Stands Firm on Uranium Enrichment, Deputy FM Confirms to NBC News - Islamic Invitation Turkey

Iran Stands Firm on Uranium Enrichment, Deputy FM Confirms to NBC News - Islamic Invitation Turkey

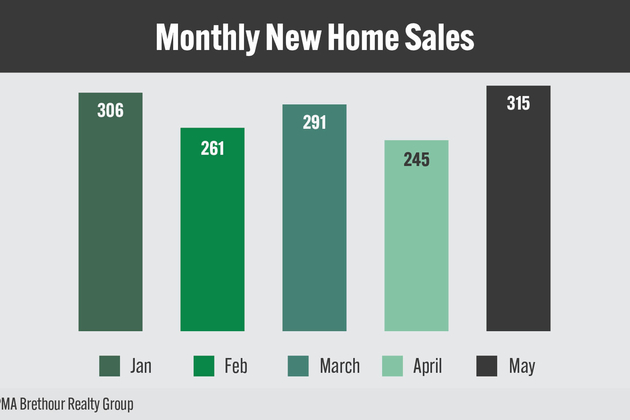

Ottawa new home sales rebound in May, still lag 2024 figures

Ottawa new home sales rebound in May, still lag 2024 figures

Strengthening economies in a stormy and fragmenting world

Strengthening economies in a stormy and fragmenting world

ECB commits to distributed ledger technology settlement plans with dual-track strategy

ECB commits to distributed ledger technology settlement plans with dual-track strategy

Business

SectionEngine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...

Nvidia briefly tops Apple’s record in AI-fueled stock rally

SANTA CLARA, California: Nvidia came within a whisker of making financial history on July 3, briefly surpassing Apple's all-time market...

ICE raids leave crops rotting in California, farmers fear collapse

SACRAMENTO, California: California's multibillion-dollar farms are facing a growing crisis—not from drought or pests, but from a sudden...

Trump signals progress on India Trade, criticizes Japan stance

WASHINGTON, D.C.: President Donald Trump says the United States could soon reach a trade deal with India. He believes this deal would...