10 loan tips for a first-time car buyer

7Newswire

15 Apr 2022, 12:32 GMT+10

Buying a vehicle is one of the most expensive purchases you'll ever make. But with the right loan, you can buy the car that fits your needs or get the best way to refinance a car. This guide will walk you through the decisions of getting a car loan and how car loans work.

Create a budget

Before you decide on getting a loan to buy a car, you should estimate the amount you are likely to spend on buying the car. To establish this amount, you will need to identify a specific car model and window shop to get the best deal. Once you have identified your budget for buying a car, you can consider your financing options.

Consider your credit score.

Did you know that buying a car with a bad credit score might seem impossible, but it happens? If you have a good credit score, getting a loan enough to purchase your car should not be a challenge. Your credit score is only used to determine the amount of loan you can get from finance institutions. If you have a bad credit score, you can look for the financing institution willing to give you the highest car loan depending on your budget.

Consider available financing options.

Different financial institutions will have different interests in their loans and the best way to refinance a car. Therefore, you need to identify an ideal institution with favorable payment terms. You do not want to apply for a loan that you might default on due to the unfavorable payment terms.

Consider the loan period.

When applying for a loan, many people prefer loans that will allow them to pay little installments. These loans tend to last for at least six years before the repayment is complete. Short-term loans are more favorable when buying a car because you will pay a little interest than long-term loans.

Save a down payment amount.

When you save for a down payment, you will need to top up a lower amount of money to buy the car. This amount will affect your loan terms because you will not need to pick a huge loan to buy the car. You will pay fewer amounts for the installments than a person who has not saved a down payment amount.

Consider your monthly budget goals

The decision to buy a car is not one of your decisions in a rush because you have to consider your monthly expenses. When you take a loan to buy a car, your monthly expenses will increase due to the installment payment. Therefore, you have to ensure that your monthly budget can allow you to add an extra expense to your finances. This is a necessity for the people who need a loan to buy a car.

Work on your current credit score

The decision to buy a car might be a necessity in your life, but you have to consider how a loan will affect your finances. If you have a bad credit score, you are likely to put yourself in a financial crisis. Therefore, it is advisable to work on your credit score to make it easy when buying a car with bad credit.

Make loans your last option.

Many people find the cost of buying a car too high to save. Therefore, they prefer taking loans and paying back the amount in installments. If you can save for a car, it is best to avoid loans because it will save you the extra cost caused by loan interest. Otherwise, make sure you learn all about loans before you decide to take them out.

New or used car

The cost of a new car is higher than that of a used car. Once you have decided on the car you want, you will find it easy to seek the best financing option for a car loan, regardless of your credit.

Stick to a budget

Do not change your mind at the last minute because you have seen a better car model than you wanted. This is likely to change your loan's terms and, in turn, risk hurting your credit score.

Are you planning to buy a car using loans? A wide variety of offerings and deals are available for you to choose from, providing many benefits that can often make the process simple.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of London Mercury news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to London Mercury.

More InformationUK Editorials

SectionIran Stands Firm on Uranium Enrichment, Deputy FM Confirms to NBC News - Islamic Invitation Turkey

Iran Stands Firm on Uranium Enrichment, Deputy FM Confirms to NBC News - Islamic Invitation Turkey

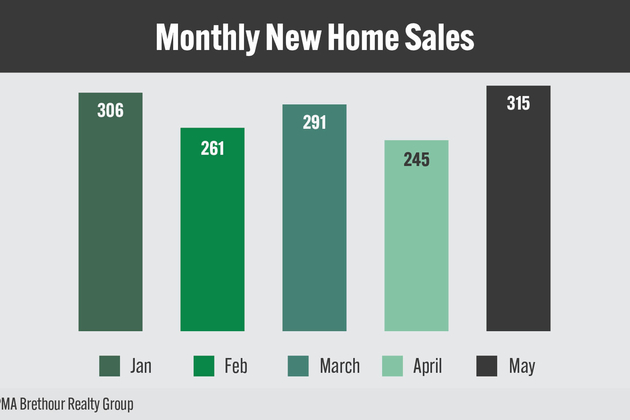

Ottawa new home sales rebound in May, still lag 2024 figures

Ottawa new home sales rebound in May, still lag 2024 figures

Strengthening economies in a stormy and fragmenting world

Strengthening economies in a stormy and fragmenting world

ECB commits to distributed ledger technology settlement plans with dual-track strategy

ECB commits to distributed ledger technology settlement plans with dual-track strategy

Deepening our commitment to confronting the climate and nature crises

Deepening our commitment to confronting the climate and nature crises

Business

SectionEngine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...

Nvidia briefly tops Apple’s record in AI-fueled stock rally

SANTA CLARA, California: Nvidia came within a whisker of making financial history on July 3, briefly surpassing Apple's all-time market...

ICE raids leave crops rotting in California, farmers fear collapse

SACRAMENTO, California: California's multibillion-dollar farms are facing a growing crisis—not from drought or pests, but from a sudden...

Trump signals progress on India Trade, criticizes Japan stance

WASHINGTON, D.C.: President Donald Trump says the United States could soon reach a trade deal with India. He believes this deal would...