How to improve your personal finances in 2023?

7Newswire

26 Feb 2023, 18:49 GMT+10

After the consumption of the holiday season, January and February come with new needs. Seasonal expenses, increases in the prices of different goods and services, and resolutions for the coming year make this a time to put order to finances and optimize the management of the family budget.

From inflation to high-interest rates and a possible recession, this year has gotten off to a rough start for most people in virtually every country in the world. But there is a silver lining: seasons of crisis are powerful motivators to stick to our financial resolutions and develop the habit of properly managing our income.

Responsible daily spending, saving to fulfill dreams and/or face contingencies, and investing for growth make money management especially important during the first weeks of the year if we want to ensure our financial well-being for the coming months.

Recommendations to improve personal finances

It is important to measure your spending. Establish a budget to have quantified all the needs of the month, not only recurrent consumption (such as utilities) but also those that are temporary, such as school purchases and commitments inherent to debts if you have them.

Therefore, it is key to suspend unnecessary or impulse purchases. And watch out for ant expenses. They could be a small amount but if you spend very frequently when added up, they have a significant impact on your monthly consumption.

Saving and the investment opportunity is a decision that cannot be put off. By controlling spending, it is possible to give more space to savings which, although it is recommended to be at least 10% of income, the important thing is that it is permanent to create the habit and to have resources to meet unforeseen events, emergencies, or to fulfill medium and long term purposes (travel, moving house, children's education, investing, etc.).

Pay special attention to debts if you have them

Prudence in debts. Debts are not bad, but it is important to understand that it is necessary to take credits with rates and terms that adapt to the need (for example, not to pay the market of a month in six installments).

If you have loans, especially credit cards, or debts with other people, it is best to pay them off before starting to save or invest.

When to invest?

It is always a good time to invest. The important thing at this point is to have some liquidity available to take advantage of opportunities when they come, to understand what you are investing in, what term you need the resources for, and how much risk you are willing to assume. There are high-yield platforms that offer good opportunities to invest in the short term.

It is also essential to seek expert advice and understand that the past performance of an investment does not assure future performance.

Although a more moderate economy is on the horizon this year, each person should appeal to prudence and plan to ensure their financial well-being in any situation.

Prioritize your well-being and invest a percentage for growth.

Financial stress weighed on many of us in 2022. Specialists say that when someone has psychological problems it impairs their ability to connect with confidence and creativity, crucial aspects to work and generate wealth.

We hope that with these recommendations you can have a year of improvement and growth in your finances despite the crises you may be facing worldwide.

Financial experts always recommend prioritizing investment to be able to grow monetarily and stabilize your resources to live in an environment of comfort and well-being, with this idea, we're sharing with you a platform of high performance and security in its operations called BULLX2 is a good option for a short-term investment. Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of London Mercury news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to London Mercury.

More InformationUK Editorials

SectionSA Police Commissioner Grant Stevens opens up about 1991 firearm incident

SA Police Commissioner Grant Stevens opens up about 1991 firearm incident

Iran Stands Firm on Uranium Enrichment, Deputy FM Confirms to NBC News - Islamic Invitation Turkey

Iran Stands Firm on Uranium Enrichment, Deputy FM Confirms to NBC News - Islamic Invitation Turkey

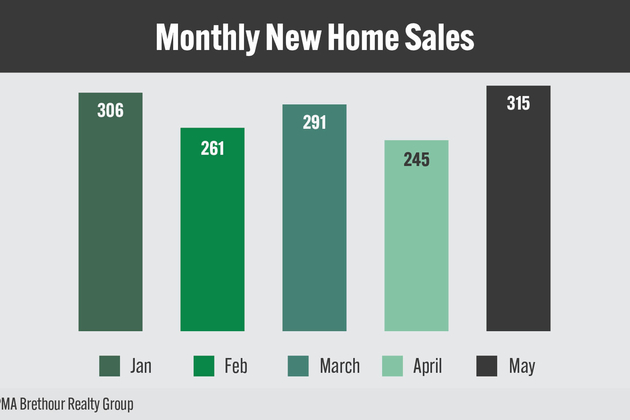

Ottawa new home sales rebound in May, still lag 2024 figures

Ottawa new home sales rebound in May, still lag 2024 figures

Strengthening economies in a stormy and fragmenting world

Strengthening economies in a stormy and fragmenting world

ECB commits to distributed ledger technology settlement plans with dual-track strategy

ECB commits to distributed ledger technology settlement plans with dual-track strategy

Business

SectionEngine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...

Nvidia briefly tops Apple’s record in AI-fueled stock rally

SANTA CLARA, California: Nvidia came within a whisker of making financial history on July 3, briefly surpassing Apple's all-time market...

ICE raids leave crops rotting in California, farmers fear collapse

SACRAMENTO, California: California's multibillion-dollar farms are facing a growing crisis—not from drought or pests, but from a sudden...

Trump signals progress on India Trade, criticizes Japan stance

WASHINGTON, D.C.: President Donald Trump says the United States could soon reach a trade deal with India. He believes this deal would...