What is Penny Stock: A Comprehensive Guide

7Newswire

13 Sep 2023, 09:19 GMT+10

In the world of finance, penny stocks are often perceived as both enigmatic and alluring. These low-priced stocks, trading for just a few cents or a fraction of a dollar, have captured the imaginations of many aspiring investors. In this article, we will delve into the depths of the penny stock market, exploring what penny stocks are, how they work, their risks and rewards, and the strategies one can employ when trading them.

Understanding Penny Stocks

The Basics

Penny stocks, also known as micro-cap stocks, are shares of small companies with relatively low market capitalization. These companies typically have a limited operational history and often operate in emerging industries or niche markets.

Characteristics of Penny Stocks

- Low Share Price: Penny stocks are usually priced at less than $5 per share.

- High Volatility: They exhibit significant price fluctuations over short periods.

- Limited Liquidity: Due to their small market capitalization, buying and selling penny stocks can be challenging.

How Penny Stocks Work

Penny stocks are traded on various stock exchanges, including over-the-counter (OTC) markets. Investors buy these stocks with the hope that their value will increase significantly, allowing them to sell for a profit.

Pros and Cons of Penny Stocks

Advantages

- Affordability: They are an affordable entry point for novice investors.

- Profit Potential: Penny stocks can yield substantial gains if chosen wisely.

- Opportunity for Growth: Some successful companies began as penny stocks.

Disadvantages

- High Risk: The volatile nature of penny stocks makes them risky investments.

- Lack of Information: Limited information and transparency about these companies.

- Scams and Fraud: Penny stock markets are susceptible to fraudulent schemes.

How to Invest in Penny Stocks

- Research and Due Diligence

Before investing in penny stocks, conduct thorough research on the company, industry trends, and financial health. You can visit some websites to search for the best penny stocks and read their reviews and insights.

- Diversification

Spread your investments across various penny stocks to mitigate risk.

- Setting Realistic Goals

Establish clear investment goals and risk tolerance levels.

Strategies for Penny Stock Trading

- Day Trading

Buy and sell penny stocks within the same trading day, capitalizing on short-term price fluctuations.

- Swing Trading

Hold penny stocks for a few days or weeks to capture medium-term gains.

- Long-Term Investing

Invest in select penny stocks with strong growth potential for the long run.

Are penny stocks a good investment for beginners?

Penny stocks can be appealing for beginners due to their affordability, but they also carry higher risks. Novice investors should proceed with caution and conduct thorough research.

What are some red flags to watch out for when investing in penny stocks?

Beware of companies with limited financial disclosures, sudden promotional campaigns, and stocks that are artificially inflated.

How can I find reliable information about penny stocks?

Look for credible financial news sources, conduct company research, and consider seeking advice from experienced investors.

Can I make a substantial profit with penny stocks?

While it's possible to profit from penny stocks, it's important to manage expectations and understand the associated risks.

Is it advisable to invest a significant portion of my portfolio in penny stocks?

No, it's not advisable to allocate a large portion of your portfolio to penny stocks. Diversification is key to managing risk in your investment portfolio.

Conclusion

Penny stocks, with their allure and volatility, can be a captivating investment option. However, they come with significant risks, and investors should exercise caution and due diligence when trading in this market. As with any investment, it's essential to research thoroughly, diversify your portfolio, and set realistic goals. Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of London Mercury news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to London Mercury.

More InformationUK Editorials

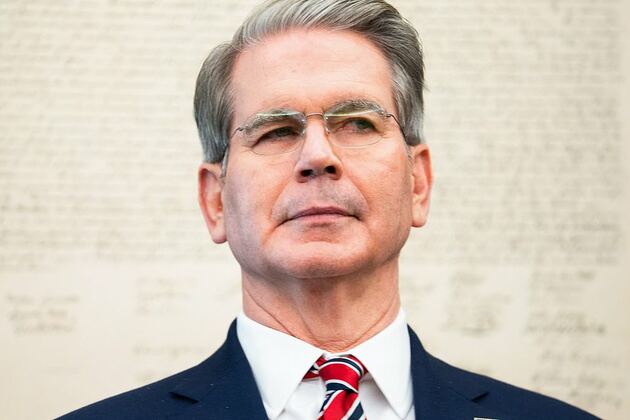

SectionTimes-Shamrock Moves Ahead With New COO, Acting CEO

Times-Shamrock Moves Ahead With New COO, Acting CEO

European Central Bank head- Frequent shocks to economy make inflation more unpredictable

European Central Bank head- Frequent shocks to economy make inflation more unpredictable

Airport bomb threat sparks warning for Aussies travelling to popular holiday destination

Airport bomb threat sparks warning for Aussies travelling to popular holiday destination

Bessent reminds CBS anchor about wrong inflation prediction

Bessent reminds CBS anchor about wrong inflation prediction

Business

SectionGrammarly acquires Superhuman to boost AI workplace tools

SAN FRANCISCO, California: Grammarly is doubling down on AI-powered productivity tools with the acquisition of Superhuman, a sleek...

Standard and Poor's 500 and and Nasdaq Composite close at record highs

NEW YORK, New York -U.S. stock markets closed with broad gains on Thursday, led by strong performances in U.S. tech stocks, while European...

Persson family steps up H&M share purchases, sparks buyout talk

LONDON/STOCKHOLM: The Persson family is ramping up its investment in the H&M fashion empire, fueling renewed speculation about a potential...

L'Oreal to buy Color Wow, boosts premium haircare portfolio

PARIS, France: L'Oréal is making a fresh play in the booming premium haircare segment with a new acquisition. The French beauty conglomerate...

Robinhood launches stock tokens for EU investors, adds OpenAI

MENLO PARK, California: Robinhood is giving European investors a new way to tap into America's most prominent tech names — without...

Wall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...